(Published Sept. 18, 2017)

The pause that refreshes. That’s a common phrase and for good reason: it’s accurate.

As easy as it may sound to understand, and it is easy, that doesn’t mean pauses don’t come without challenges. Investors tend to be impatient beasts. We want our gains and we want them now.

Pausing doesn’t exactly satisfy this need, but an investor that can master this art can shift risk vs. reward parameters in their favor.

Abiomed (ABMD) is a name introduced back on July 5 with the launch of our newsletter.

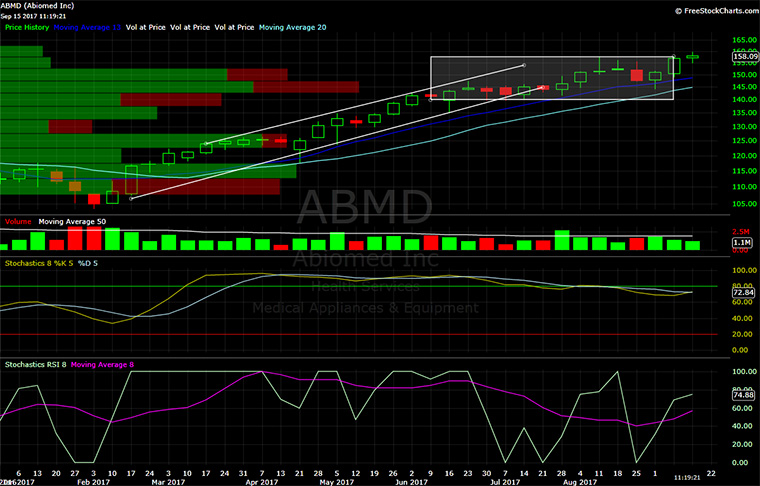

The stock was trading at support in the low $140s, nestled in a strong bullish channel that began in February 2017 and carried the stock from to $147 from $105.

One week into the position and the pattern started to shift. While ABMD managed to close the week inside the channel, most of the trading occurred under the rising support level.

Two weeks into the position and the channel support was broken. That’s enough to send some investors to the sidelines, but interestingly enough, there was a secondary support we alluded to in our analysis that held strong, the 13-week simple moving average (SMA).

Our focus shifted away from the channel and to the SMA. Price stopped moving higher, but it did not turn lower in any significant way.

So, we watched as the price bounced off the 13-week SMA several times over the next month.

Furthermore, the StochasticsRSI retraced to 0 several times, as well with price bouncing each time. It was no coincidence those touches of 0 corresponded with touches of the 13-week SMA. The stronger volume weeks came on bounces, while reluctant sellers hit shares occasionally and ABMD worked off the long-standing overbought condition.

ABMD paused, but it didn’t break.

ABMD paused and gave those who missed the initial entry a chance to join the trade.

ABMD paused … until it didn’t.

The 13-week SMA never broke and now shares are pushing $160, currently trading in the $155 to $159 range. Perhaps we have the start of a new channel here or maybe the stock continues to churn sideways.

Traders who were patient with the position can now focus on that 13-week SMA as a trailing stop or even consider the 20-week SMA. Selling at either will still lock in some attractive gains from a low $140s entry given the position is less than three months old at this point.

ABMD is typical of a common pause that refreshes pattern and certainly worthy of study for those who have challenges remaining patient, especially with new positions.