The Uncommon Idea in Brief

Buy circulatory system medical device company Abiomed (ABMD) stock for the long term. (Published July 5, 2017)

-In the short term, Abiomed offers a solution to an unmet need in an underserved, growing market. We’d begin building a position between $130 and $140 while adding in case of earnings weakness or perceived forex weakness.

The Industry Opportunity

Heart failure and coronary disease are the number one causes of death in the United States.

Currently, one in three deaths, or 900,000 each year, fall into this category. Heart failure affects 5.7 million Americans and is expected to increase by 46% by 2030.

Additionally, there is a lack of treatment options for high-risk patients with severe coronary artery disease or depressed ventricular ejection fraction (where the heart muscle is not contracting effectively and less oxygen-rich blood reaches the body).

A 2014 study showed that the use of short-term mechanical support in the United States reduced hospital mortality rates while also reducing hospital costs.

What Abiomed Does

Abiomed provides medical devices that support the circulatory system. Its products are designed to enable the heart to rest by improving blood flow and/or performing the pumping of the heart.

The company offers the Impella 2.5, Impella CP and Impella 5.0 heart pumps used to treat heart-attack patients in cardiogenic shock. These pumps have the unique ability to enable native heart recovery, allowing more patients to return home with their own hearts.

The installed base for Impella 2.5 heart pumps grew by 20 hospitals last quarter and the company now has an install base of 1119 sites. Additionally, the company increased the installed Impella CP heart pumps by 49, bringing to the total Impella CP sites to 972.

The Uncommon Market Position

Abiomed has already surpassed 50,000 Impella patients treated in the United States. With the ability to treat high-risk patients with Percutaneous Coronary Intervention (PCI) procedures (a non-surgical procedure to place a stent in a blood vessel), ABMD has only begun to scratch the surface of an unmet market.

Impella is currently used in only 1% of PCIs and less than 10% of patients experiencing an acute myocardial infarction (AMI) complicated by cardiogenic shock. This equates to tens of thousands of patients remaining untreated and potentially unaware of the procedural options from Impella.

Currently, Abiomed generates 90% of its revenue from the United States. But worldwide revenue is growing. Germany is responsible for the majority of what the company earns abroad. International growth of 80% is outpacing domestic growth by a large margin and could fuel growth for the next decade.

What Sets Abiomed Apart

Impella has been shown to reduce length of stay, reduce remission rates and be cost effective. The combination of cost savings and lifesaving immediately vaults ABMD’s offerings into every conversation of heart failure care plus budget concerns.

Additional, the Impella CP recently received expanded FDA approval for high-risk PCIs, possibly the most unmet need in the heart space.

Financial Services – Abiomed by the Numbers

Abiomed’s growth will get the blood flowing.

The company had a 34% growth in revenue in 3Q 2017, hitting $114.7 million. GAAP earnings per shares came in at $15.4 million, or $0.34 per share, up from $0.23 per share a year earlier. Sales are expected to climb higher at 34.5% per year with earnings growth slightly trailing at 26.67%.

The company finished the quarter with $258.9 million in cash, or $5.53 per share, paired with no debt.

The Impella heart pumps are core of the company, with sales of $109.2 million. Sales in the United States grew to $100.3 million, while worldwide sales jumped 80% to $8.9 million.

Germany will create a little more volatility in Abiomed’s earnings as foreign currency exchange rates could impact the bottom line.

Gross margins dipped slightly to 83.4% from 85.1% as the company transitioned to a greater bulk of revenue stemming from its newer Impella lines. But with the greater appeal of the newer products, the boost to the top line outweighs any dip in the gross margins.

Looking forward to fiscal 2017, management expects $440 million to $445 million in total revenue, an increase of 34% to 35% from 2016. Fourth-quarter revenue of $122 million is expected, with operating margins of 18% to 20%.

Why the Stock Is a Buy

Abiomed has barely scratched the surface of the 5.7 million Americans affected by heart failure. Additionally, there are tens of thousands of patients who, until recently, had no options available for care like Impella.

Earnings per share will have to grow quickly to fill the big shoes of the triple-digit price-to-earnings ratio, but ABMD has less than 10% of the US market, less than 1% of the PCI market and is just beginning to expand into the international markets.

Price is likely going to play with your pulse rate a bit as volatility will be around this name for the next few years. But even if it is not bought out in the next 24 months, the long-term value and growth potential remains solid.

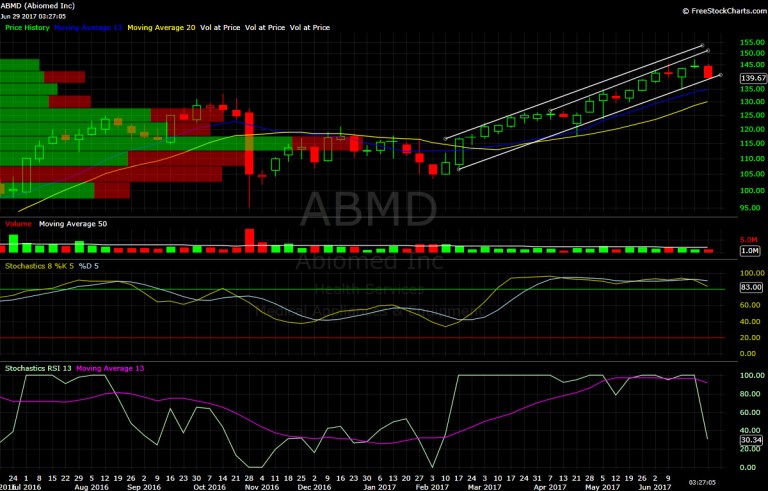

The Technical Analysis — On a Breakout Over $127 or a retest of $117 or lower, ABMD is a BUY

Abiomed has bounced back strong after a challenging autumn in 2016. The stock has steadily marched higher in 2017 via a very strong and orderly bullish channel, pushing shares from $100 as high as $147.45.

The trend for the past five months of the year has been clearly higher. A somewhat-narrow bullish channel has guided the stock. Shares haven’t closed below the 13-week or 20-week simple moving average (SMA) since February. Touches of the both SMAs have been opportunistic buys during 2017. The question here is whether the support level of the bullish channel holds or if we’ll test the 13-week around $135.

The current pullback has occurred on average volume and has been orderly in comparison with the market. While we have the makings of a bull flag in terms of price action with the $137 to $144 range, it hasn’t existed long enough to classify it as such yet.

The biggest challenge is the bearish crossover (%K line moving below the %D line) in the Stochastics. But the indicator is still above 80 and while it’s there, we’d still consider the indicator bullish. Unfortunately, the Stochastics RSI has fallen sharply and hints at caution.

Our target on a breakout over $145 is $153 in the next two to three months, with $170 being the 12-month target as we anticipate the extension of the breakout would roughly equal the move of the February breakout to the early June highs.

We view $135 as the next level of support should the current level of $140 fail. If ABMD breaks below $134, we anticipate a new trading range developing between $125 and $133. If there are no fundamental changes to the company, we would use support areas to add to our position and take partial opportunistic sales into resistance levels.

Our preference is to take a medium-sized entry here and then look to add aggressively on a pullback toward the 20-week SMA around $132.

Catalysts for the Thoughtful Investor

Again, forex is the only driving concern for ABMD, but we would use any weakness on earnings associated with forex as an opportunity to accumulate shares.

With the recent FDA expanded approval, the additional Impella sites, along with potential international growth, ABMD also sets up as an attracted takeover candidate to larger medical instrument companies or even pharma names.

A study published in March in Circulation Research, a biweekly medical journal, demonstrates Abiomed’s Impella 2.5 heart pump can reduce the risk of acute kidney injury during high-risk PCI. This study endorses management’s claims of the additional benefits provided by minimally invasion heart pumps.

With the additional news of the possible benefits to a patient’s kidney along with the unmet market of 12,000 people currently suffering from chronic and inoperable heart disease, the potential application in the largest global market of assist medical devices (the U.S.) creates a big potential impact to the bottom line of Abiomed.

The Bottom Line

-Abiomed is the clear market leader for heart failure patients in need of high-risk PCI procedures.

-The heart health of the United States is unlikely to improve any time in the foreseeable future. In fact, the market is growing rapidly and with the high likelihood future competitive treatments will require FDA approval there are high barriers to entry. ABMD has limited competition and has successfully positioned the Impella 2.5 heart pump in 1,119 sites and the Impella CP at 972 sites.

-Abiomed has only achieved less than a 10% penetration in patients experiencing an AMI complicated by cardiogenic shock and only 1% of PCIs in the United States. The unmet needs of the current and future market are not only huge, but also growing along with Abiomed domestically and internationally.

-In the range of $125 to $140, ABMD is a long-term buy and hold, although the mid-cap nature, forex impact and aggressive growth will make it volatile.

At the time of publication, neither the author nor the company held positions in the stocks mentioned, but positions may change at any time.