The Uncommon Idea in Brief

Buy surgical guidance system maker Mazor Robotics (MZOR) stock for long-term capital appreciation. (Published July 5, 2017)

-Mazor is a robotics company still in its infancy, but growing rapidly. Revenue, income and growth rates will be volatile as the company’s surgical guidance systems are implemented around the country. We’d begin building a position below $50 and add aggressively on a pullback in price driven by overall market weakness or sell-the-news reactions around earnings.

The Industry Opportunity

Robotics — not plastics, “The Graduate” aficionados — is the future, especially when it comes to medicine.

Surgery comes with varying degrees of risk. Brain and spinal surgeries, like those associated with Mazor Robotics, often come with some of the highest degrees of risk.

Integrating the sophistication of robotics along with the skill and education of highly-trained surgeons offers the potential for not only fewer errors, but also procedures on conditions previously deemed inoperable. Recovery times have been reduced while success rates have been increased.

Even without potential expansion, the global spine surgery market is estimated to reach $17 billion by 2021, increasing at a compounded annual growth rate (CAGR) of 5.3%. Mazor has only started earning revenues outside of the United States and its share of this multi-billion-dollar market is less than 1%.

In April 2017, Mazor Robotics received FDA clearance for Mazor X Align software. The product is designed to assist surgeons in planning spinal deformity correction and spinal alignment for procedures performed with the Mazor X Surgical Assurance Platform.

This is an extension of the Mazor X proprietary pre-operative analytics software suite, which allows medical professionals to create a 3-D spinal alignment plan. The company anticipates a widespread release in the second half of 2017 now that it has FDA approval.

What Mazor Does

Mazor Robotics produces surgical guidance systems for spine and brain procedures. Currently, it offers the Renaissance and Mazor X platform/system to medical facilities.

These guidance systems are designed to simplify spinal procedures/surgeries and brain surgery.

The company draws revenue three ways:

-Selling Robots. Currently, robots are priced at $1.1 million each.

-Disposables the robot consumes during procedures.

-Service and support.

Mazor robots have produced six times fewer complications or the need for a repeated procedure. Hospitals are promoting the availability of Mazor Robots as a means of attracting patients, especially when competing facilities lack them.

The Uncommon Market Position

The strongest comparison on the competitor side is Intuitive Surgical (ISRG).

In some regards, it may seem odd to compare a company with a $32 billion market cap with one trading just under $1 billion. But other than Verb Surgical, a private joint venture of Johnson & Johnson (JNJ) and Alphabet (GOOGL), this subsector of healthcare remains in its infancy with little population.

Intuitive Surgical trades at a price-to-sales of 11.4x vs. Mazor’s price-to-sales ratio of 23x. The difference is growth. Sales numbers at Intuitive surgical have slowed into the 9% to 14% range, while Mazor revenue growth hovers around 80% due to its smaller size. In terms of price-to-sales divided by growth, Mazor trades at a significant forward discount compared with Intuitive Surgical.

What Sets Mazor Apart

As addressed, Mazor Robots are experiencing six times fewer complications and repeated procedures.

While we often spend time outlining a long explanation of a company’s edge in the marketplace, that one sentence is all we need for Mazor.

Hospitals and medical facilities promote the availability of Mazor Robots. Given the encouraging results and the FDA approvals associated with the product, Mazor X robots are quickly becoming the best in class for spinal and brain surgeries.

Financials — Mazor by the Numbers

Mazor not only has to prove its robotics is safe, but convinced medical facilities to sink large initial investments to use them. Based on the past several quarters of revenue, it’s been successful.

1Q 2017 picked up where the 4Q 2016 left off. Revenues increased 83% year over year to $11.7 million. The company predicted $11.5 million, so business saw a small tick above expectations. While there was a net loss of $5.2 million, $0.11 per share, and cash flow was positive $700,000.

The positive cash flow is a significant development as the company burned $1.9 million in Q4. The company finished the quarter with $63.9 million in cash and cash equivalents, an increase from $61.8 million in 4Q.

As mentioned earlier the company draws revenue from selling robots/platforms (robots priced at $1.1 million each), disposables the robots consumer during procedures (system kits) and service and support.

Revenue from selling robots/systems are recognized when the systems are supplied, not when they are ordered. For a small, high-growth company, we prefer this conservative approach to revenue recognition.

The second and third categories create recurring revenue. In Q4, $4.5 million in revenue came from systems kit sales and services. That’s a 29% jump. For the year, recurring revenue was $16.8 million of a total of $36.4 million.

The importance of a young company creating recurring revenue that accounts for a significant portion of total revenue can’t be stressed enough.

Mazor ended 2016 with an order backlog of 14 Mazor X systems and delivered 12 systems in the Q1 2017. The company received purchase orders for six new systems in Q1 and there have been four orders already in Q2. The current backlog is 14 systems.

During the quarter, Mazor saw record utilization of its installed system base. Margins did thin down from the low 70% area down to 64.6% as some clients traded in the Renaissance system for the newer Razor X and the company offered discounted pricing to distribution partners. Given more systems in place will increase recurring revenue, slightly lower margins are acceptable as the company will make up for it over time.

Why the Stock Is a Buy

Mazor Robotics’s growth is in overdrive, which means traditional fundamental metrics will take a backseat.

Investors focused on price-to-earnings, book value, price to sales, price to free cash flow, or PEG ratios will likely never see MZOR on their screens. This is a small-cap company that has drawn in big-size short interest as the short float has climbed to 11% of the outstanding shares, which would take five days to cover at average trading volume.

The company holds no debt and offers a strong cash position, now around $2.70 per share. While traditional fundamentals won’t draw investors into MZOR, the aggressive growth and unique sector will translate to a buy for momentum investors with the most aggressive palate.

Investors must consider rival Intuitive Surgical is profitable, with strong profit margins, unlike Mazor, which explains a portion of the discount. But we still feel a fair 12-18 month valuation is $75 to $85 per share, maintaining the same 23x price-to-sales ratio moving forward.

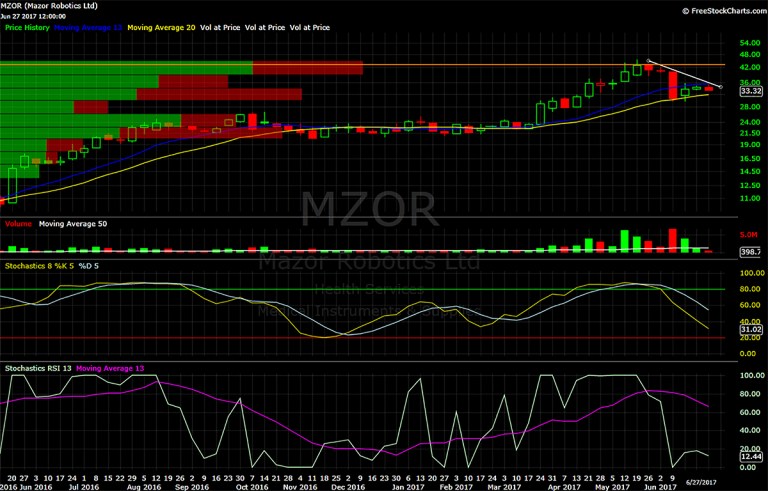

The Technical Analysis — At $36 or Lower MZOR is a Speculative BUY, but We’d Prefer Buying on a Close over $36; Between $24 and $28 MZOR is an Aggressive Buy

Mazor’s technical setup is precarious at the moment.

Opportunity comes hand-in-hand with risk. Price recently broke the 13-week simple moving average (SMA) and tested the 20-week SMA for the first time since March 2017. The positive here is the test of the 20-week SMA was successful and price held strong. The issue is the bounce into the 13-week SMA was rejected and now that level has morphed into resistance.

We have a declining resistance level that began at the end of May when Mazor failed to breakout above $44. These converging levels have created a squeezing pennant with Mazor shares poised to break down or break out violently.

There’s plenty big short interest in Mazor and if shares close below $32 on a weekly basis, the recent shorts may just prove correct. Should we see a breakdown, we would target $25 as our optimal entry point to establish a large position, but would begin nibbling at $28.

On the other hand, should Mazor close above $36 on a weekly basis, we believe shares will test $44 in short order and should be purchased. Once trading above $41, the favored strategy is to wait for a pullback to the 13-week SMA or buy on a close over $44. Unfortunately, the $39 to $42 area is a coinflip in terms of risk vs. reward. Currently, there is a lot of overhead resistance with traders who purchased the stock between $32 and $44, so we preach patience and small-sizing until the picture becomes clearer.

Catalysts for the Thoughtful Investor

Mazor recently entered a strategic partnership with Medtronic (MDT) for commercialization and co-promotion of the Mazor X platform. Medtronic has made a $20M investment in Mazor Robotics and owns 7.27% of the company.

Both companies are actively investing in co-marketing, promotion, and training efforts toward the commercialization of Mazor X. Medtronic will help Mazor increase the number of highly clinical specialists raising awareness and garnering support for the platform. Over time, the potential to develop synergistic products between Mazor’s guided surgery software and Medtronic’s product portfolio offers product and revenue potential not considered in the company’s current valuation.

The company can succeed as a standalone, but it has a high probability of being purchased by a larger medical instrument or healthcare company in the next four years.

The Bottom Line

-Mazor Robotics is the best-in-class guided surgery software and robotics platform for spinal and brain surgeries.

-The medical robotics market continues to evolve and expand in terms of technology and application. Soon to be gone are the days of unassisted surgeries. Mazor’s platform and products have been shown to reduce complications and the need for repeated procedures creating both satisfied patient and successful medical professionals.

-Even as a young company, Mazor has created three different pillars of income, two of which are recurring. The growth on the top line, the bottom line and the recurring line show no signs of slowing. The company should be profitable by the full year 2019 and potentially profitable in the second half of 2018.

-In the range of $35-50 we posit MZOR a long-term buy and hold, although the small-cap nature, high short interest and relative infancy of its technique in the healthcare sector will make price action volatile.

At the time of publication, neither the author nor the company held positions in the stocks mentioned, but positions may change at any time.